As a financial professional, you are probably familiar with the 5:00 p.m. reconciliation scramble. Another busy workday in the heart of the (inter)national financial heartland draws to a hectic close. But there’s still that last-minute OTC deal that has to be confirmed just before the market closes. While you’re closely monitoring and switching between 5 different tabs on your computer, double-checking all the relevant emails, and searching for the right templates, you are also busy adjusting notional values.

Yes, you’ve managed to send out the OTC deal in the nick of time! Or have you, despite all of your efforts, been beaten by the merciless deadline? This uncertainty and the aforementioned operational challenges are very real when handling OTC confirmations is still a predominantly manual affair. Manual OTC management can be time intensive and increases the risk of human error, making it a silent deal killer that secretly Prowls the financial realm, hell-bent on eating up your margins. The good news? Lightweight automation on top of your existing systems and workflows effectively eliminates this secretive assassin.

Unraveling the problem

Copying and pasting small fragments of data or making a couple of small adjustments in your term sheets manually. It looks and feels like a harmless and completely normal routine that doesn’t seriously affect your workflows or operational efficiency. But when you add up those small, seemingly trivial actions across instruments, mandates, and valuation points, a clear picture emerges: a persistent bottleneck and an often-overlooked efficiency killer.

The hidden costs of manual OTC confirmations

Multiple copy and paste sessions, the chaos that ensues from the process of manually tracking and managing the different drafts of term sheets, confirmations or KIDs, and hectic last-minute fixes are hindrances that seriously cripple your operational efficiency and compliance efforts. Although these hidden costs are not visible in Excel, they will sure as hell show up in your profit-and-loss balance.

Like clever shapeshifters, manual trade document problems manifest themselves in different ways:

Operational risk hiding in plain sight. Manually updating terms, conditions, or settlement details increases the likelihood of human error — especially when several trades are being processed in parallel. A small mistake in a clause or figure can lead to costly corrections, disputes, or compliance concerns.

Version confusion that undermines control. When multiple people work on the same trade documentation, it’s easy for parallel versions to circulate. Aligning them afterwards is time-consuming and introduces additional risk.

Reputational impact that travels fast. In a market built on trust, repeated corrections or inconsistencies can quickly raise questions about reliability. Even if the financial loss is limited, the perception damage can be far more difficult to repair.

Efficiency loss and growing internal frustration. Manually copying, checking, and reconciling data is slow and interrupts the trader’s focus. Over time, this drains capacity, affects morale, and reduces the speed at which teams can safely process workloads.

A mistake is not merely a mistake in the world of capital market operations

Not all mistakes are problematic. But in a heavily regulated financial market, a mistake is not simply a learning moment. For example, pricing and notional mistakes often have a serious impact on counterparty trust. Most potential partners or customers will (rightfully so) only want to deal with organisations that are able to fulfill their financial obligations.

Is your version management a cluttered mess? Does your data follow a fragmented journey that is riddled with tons of emails and spreadsheets or suffers from fragmented data that you have to copy from system to system in a manual fashion? Or do your workflows and software systems lack state-of-the-art, realtime tracking options? Then be prepared for a lot of auditing stress.

Manually processing large chunks of (often sensitive) data also paves the way for human errors and increases compliance pressure. If these errors aren’t noticed and rectified quick enough, hefty fines, outdated trade parameters, incorrect bookings, delays (that can make the difference between closing a lucrative deal or staying behind empty-handed), and risk aversion by counterparties become very real dangers.

The route to redemption: Lightweight automation on top of existing systems

Luckily, the smart use of modern technology can safely guide you through the treacherous and choppy waters of modern-day OTC trading. And with the right strategy and tech choices, you don’t necessarily have to rebuild your existing stack from scratch to be compliant and efficient.

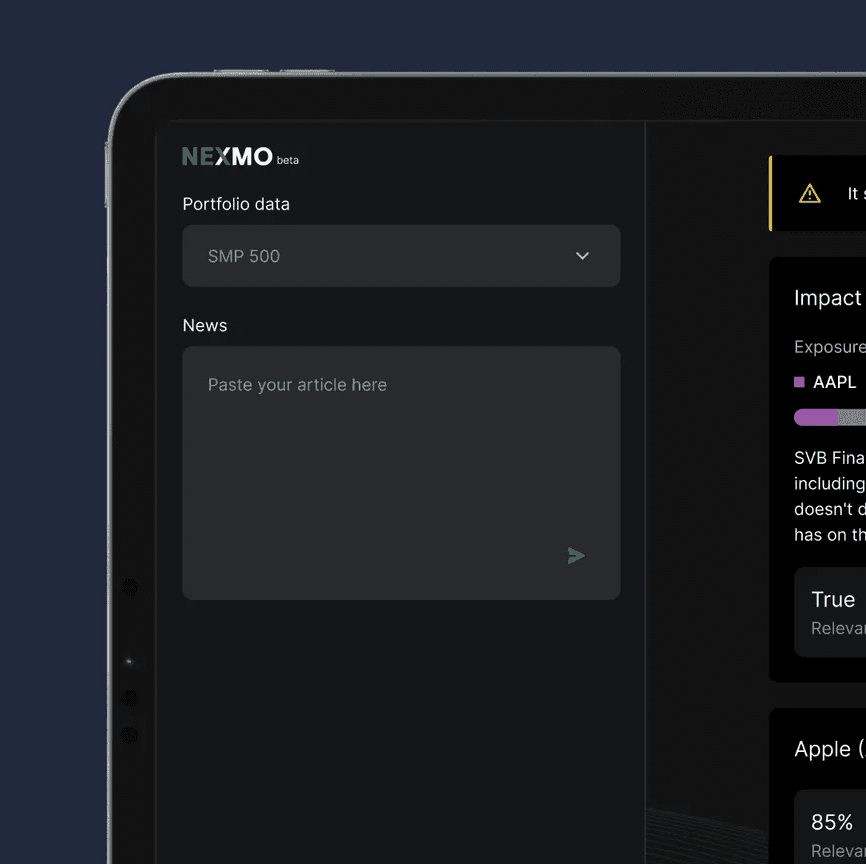

Especially when you layer lightweight automation on top of existing trade systems, you open the door to a much broader universe of OTC and term-sheet improvements; far beyond what manual workflows can ever deliver. Say goodbye to tiresome manual processes and create documents that are factually accurate and audit-proof in just a handful of seconds.

Tradingterms takes the principle of lightweight automation on top of existing trade solutions to the max. You can expect:

Flawless term sheets, confirmations and KIDs that are generated in realtime. No more version chaos, manual fixes or costly errors. Just plug in the trade data and Tradingterms handles the rest.

Increased consistency. The documents that you produce are fully branded, client-ready, and generated to pass audits.

Security and scalability. Run all of your capital market operations and trading document workflows in a heavily-secured cloud environment. VI Company has successfully completed ISO 27001 and ISAE 3402 Type II audits. Our solutions are trusted by a wide array of leading financial institutions.

A flexible solution that is surprisingly easy to integrate with a wide variety of trade tooling through APIs. Tradingterms fits seamlessly alongside your existing systems and helps you adapt to current and rapidly changing trade volumes. There’sno need to replace tooling or force new workflows, and you’re not dependent on scarce IT capacity or long implementation cycles.

Your big win? Higher efficiency and a faster time-to-market, while significantly reducing operational risk across your documentation process.An easy set-up for multilingual supported documents. Whether you need documents in French, German, Spanish or other languages, Tradingterms makes it happen.

Would you like to know more?

The biggest overall gain of OTC document automation: A dramatic reduction in operational risk with cleaner, more consistent, compliant documents without disrupting your team’s familiar workflows.

Discover how Tradingterms can help you generate error-free OTC documents in seconds and slay the silent deal killer that manual OTC management often is. Compliant, fast, and without disrupting your flow. Feel free to contact us for a demo!

SHARE ON SOCIAL MEDIA