NEXMO: AI revolution in investment analysis

Nexmo provides insightful correlations between news and investments, transforming decision making in the financial sector.

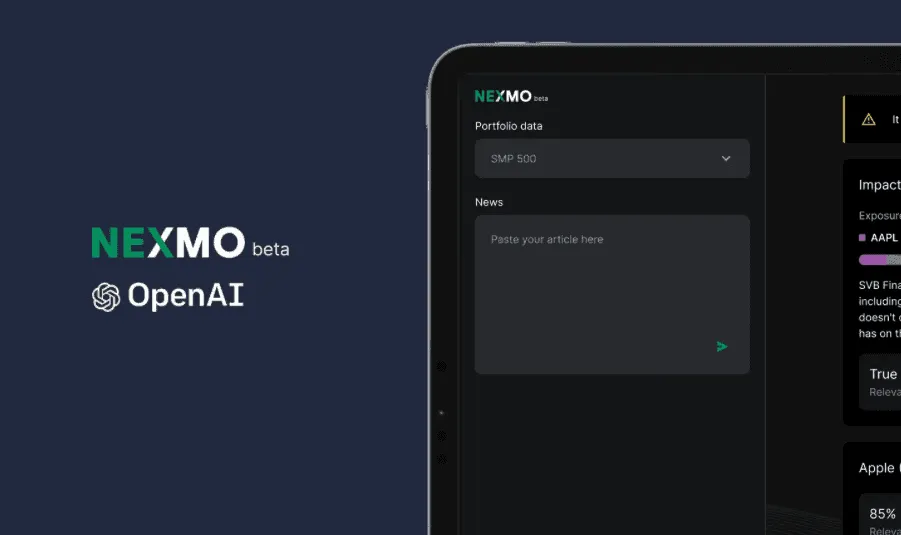

VI Company has developed the News and Exposure Monitor (NEXMO). An innovative AI monitoring tool that establishes a relationship between news and investments. This intelligent solution eliminates the need for expensive data management solutions. The tool provides insightful correlations between news and investments, transforming decision making in the financial sector.

Transforming Investment Analysis: AI-enhanced insights for strategic decisions

The goal of the News and Exposure Monitor (Nexmo) is to provide investors with an efficient tool that shows the direct impact of news on their investment portfolio. Traditional methods require extensive manual analysis, which is both time consuming and costly. NEXMO, powered by AI and OpenAI's GPT model, significantly streamlines this process, providing a time and cost saving solution. This technology enables in-depth news analysis and links relevant data such as countries, sectors and companies to investment portfolios. This allows investors to make faster, more informed decisions.

Nexmo's innovation lies in its ability to combine code developed by VI Company with OpenAI's AI model. This combination ensures that Nexmo is able to analyse news reports in depth, using key information such as countries, sectors and specific companies. This data is then linked to the specifics of investment portfolios. This creates a direct and reliable link between news content and investment decisions. Investors can make more informed decisions based on the most up-to-date information.

NEXMO uses OpenAI's GPT model to develop a powerful dataset containing essential information on countries, sectors and companies. This enables users to quickly understand the impact of news on their investment portfolios. Integrating the GPT model into the Nexmo prototype enables news stories to be linked to investment portfolios quickly and efficiently. The system analyses news content, filters out the most relevant information and links it directly to investment portfolio characteristics.

This integration of AI technologies enables efficient and accurate linking of news content to investment portfolios. The process of linking news to portfolios is fully automated. This automates what was previously a time-consuming and costly task. NEXMO is unique in its ability to automate complex data analysis and deliver instant, relevant insights to investors. By tagging data and making correlations between news and portfolios, NEXMO provides a risk-free tool that does not use generated AI, thus ensuring data integrity.

Although AI models rely on complex algorithms and data, they cannot yet replace all human judgement. The insights from the Nexmo prototype serve as additional information in investment decisions, underscoring the importance of human insight. With Nexmo, VI Company is taking a step forward in technological innovation to provide clients with advanced tools for accurate analysis and risk assessment of investment portfolios.

Want to take our NEXMO prototype for a spin? Check it out here