The essence of KYC and AML

In the financial industry, it is mandatory to verify customers with whom business is conducted. This is a result of regulations designed to prevent money laundering, terrorist financing, and other criminal activities. The Know Your Customer (KYC) and Anti-Money Laundering (AML) processes are essential for financial institutions. KYC involves identifying and verifying customers to manage risks, while AML focuses on preventing money laundering and other illegal activities.

The KYC process in detail

KYC processes can vary depending on the services a customer provides. Fundamentally, there is often an identification requirement. This can be done, for example, by validating an ID or via bank identification. Another common method is linking with the Chamber of Commerce for business entities to verify proper registration. These processes apply not only to customers but sometimes also to employees to prevent malicious individuals from infiltrating the organization, a practice known as social engineering.

Technological support for KYC and AML

Technology plays a crucial role in supporting KYC and AML processes. Many providers can support the automation of steps in the KYC process through APIs. Think of IBAN name checks or scanning and verifying passports. These technologies help make the processes more efficient and accurate.

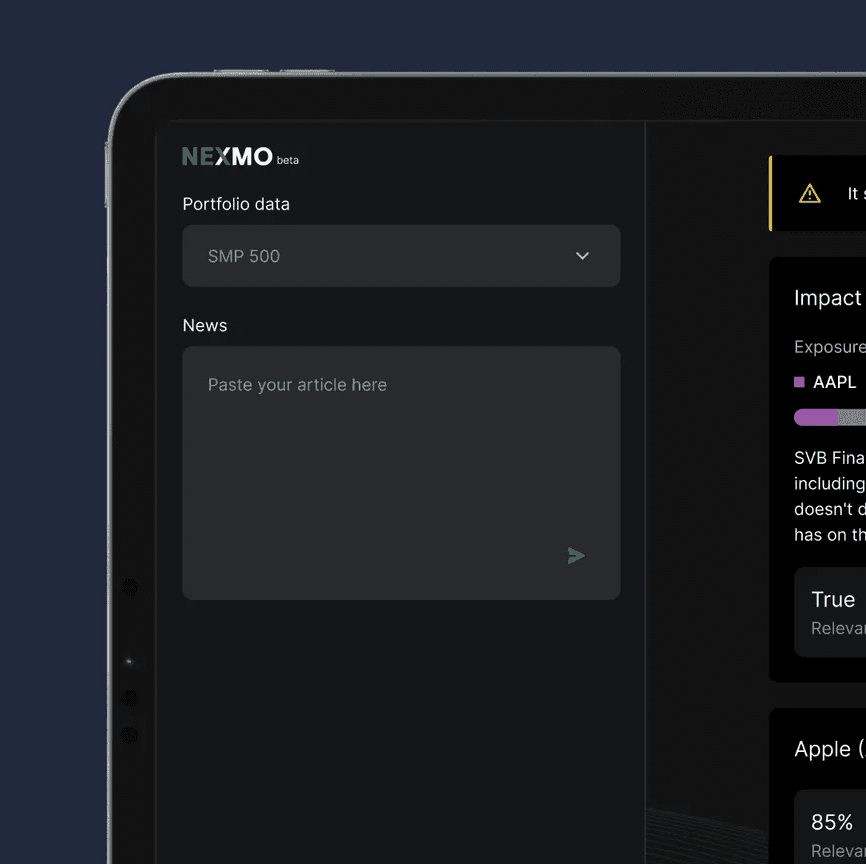

We have developed a standard solution for our client Rabobank where these technologies come together in a user-friendly interface. This interface guides customers through the process, explains why certain information is needed, and ensures that even those without technical backgrounds can complete the steps.

Challenges in KYC and AML

Despite the benefits, there are also challenges associated with KYC and AML. The regulations are complex and frequently change, making it difficult to remain compliant. Additionally, the costs of implementing and maintaining these processes can be high, especially for smaller financial institutions. Collecting and storing large amounts of customer data raises privacy issues. Financial institutions must ensure they comply with data protection regulations.

Future developments

With the rise of technologies such as AI and machine learning, these processes are becoming increasingly automated. This will not only increase efficiency but also improve the accuracy of risk assessments. Moreover, new standards and regulations are being developed to further streamline these processes.

Do you need help from VI Company?

KYC and AML are essential processes for financial institutions to protect themselves against financial crime and comply with legal obligations. Despite the challenges, these processes offer numerous benefits, including improved risk management, compliance, and customer trust. By leveraging advanced technologies and partnering with reliable entities, financial institutions can optimize and make their KYC and AML processes more efficient. In an ever-changing financial world, it is crucial for institutions to remain proactive in their approach to KYC and AML to ensure their integrity and contribute to a safe and reliable financial sector.

Reach out when you would like to know more about the standard solution. We can tell you more about the options for your company.

SHARE ON SOCIAL MEDIA